The Stamp duty and registration charges in Himachal Pradesh are decided by the State government of Himachal Pradesh (HP). The Stamp duty and registration charges in Himachal Pradesh are sometimes changed to boost the property registrations and revitalize the property market. Lower stamp duty charges encourage serious buyers to go for the purchase and register a property.

In addition to this, stamp duty for women buyers is generally kept lower to promote the property ownership of women in the state.

At present, the Stamp duty and registration charges in Himachal Pradesh are as follows-

| Stamp Duty and Registration Charges in Himachal Pradesh | ||

| Buyer Category | Stamp Duty in Himachal Pradesh | Registration Charges in Himachal Pradesh |

| Male | 6 Percent | 2 Percent, maximum amount Rs 25,000 |

| Female | 4 Percent | 2 Percent, maximum amount Rs 15,000 |

| Joint (Male+Female) | 5 Percent | 2 Percent, maximum amount Rs 15,000 |

How to Pay Stamp Duty and Registration Charges in Himachal Pradesh Online?

The Registration Department of Himachal Pradesh allows a user to calculate the stamp duty and registration charges in Himachal Pradesh online. As stamp duty rates in Himachal Pradesh are directly related to the circle rates, you can first check the circle rates online.

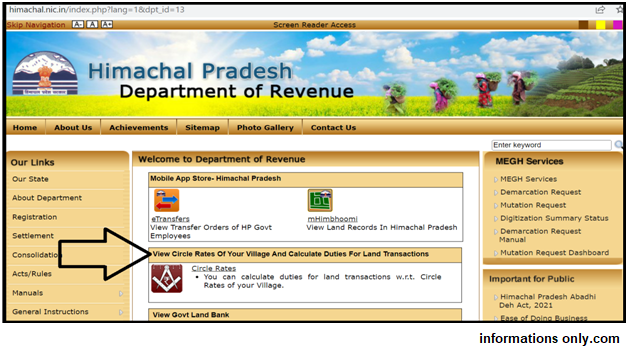

Step 1: Enter the official website of the Revenue Department of Himachal Pradesh, i.e. https://himachal.nic.in/

Step 2: On the homepage of the website of the Registration department, Click on the “View Circle Rates Of Your Village And Calculate Duties For Land Transactions”.

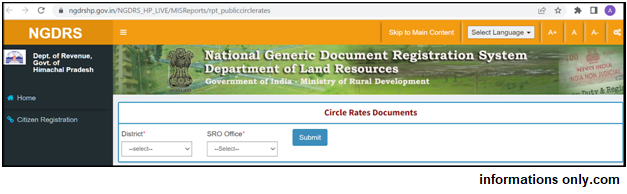

Step 3: You will be taken to the customized NGDRS portal

Step 4: Click on the ‘Citizen Registration’ option on the left pane.

Step 5: The following form will be displayed. Fill in the details such as name, address, email id, phone number, and property details and click on the Submit button. You will be registered as a User.

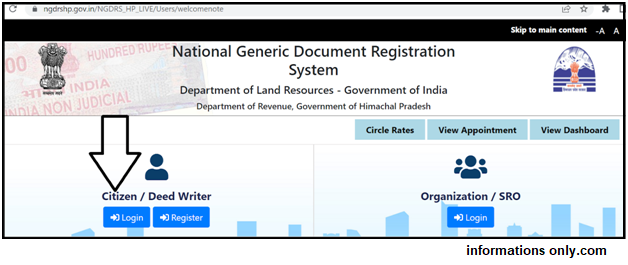

Step 6: Go to the home page and use the login id and password to login into the system.

Step 7: Once you are logged into the system, you can upload the required documents and pay the stamp duty and registration charges in Himachal Pradesh online. You can use a Debit Card/Credit Card/NEFT/RTGS/UPI/Wallet to pay the stamp duty charges in Himachal Pradesh.

Step 8: Once the required documents are uploaded, and stamp duty is paid, your appointment with the concerned SRO will be booked. On the designated date, you will have to approach the SRO office and complete the verification process.

In addition to the aforementioned method, a property buyer can make the online payment of stamp duty in Himachal Pradesh via the website of Stock Holding Corporation of India Ltd.

To make payment via SHCIL, go to the SHCIl website, choose Himachal Pradesh from the drop-down list and proceed with the online payment.

Himachal Pradesh Stamp Act 1899

The inflow of the duties and levies from stamp duty and registration charges of properties is a great source of revenue for the Himachal Pradesh government. The Stamp duty and registration charges in Himachal Pradesh are governed by the Himachal Pradesh Stamps Act 1899. The Indian Stamps Act 1889 was used to govern the Himachal Pradesh Stamps and registration procedures. However, after several amendments, the latest version of the Act serves the purpose well.

Offline Payment of Stamp Duty in Himachal Pradesh

In addition to the Online payment of stamp duty and registration charges in Himachal Pradesh, the property buyers can also pay the applicable stamp duty in the traditional offline way. The offline payment of stamp duty charges in Himachal Pradesh can be made in the following ways-

SRO Office– A property buyer can directly approach the concerned Sub registrar’s Office (SRO) and pay the requisite stamp duty in Himachal Pradesh. If you have booked an appointment slot, you can make the payment and get the documents verified simultaneously.

Bank Branches– The State government of Himachal Pradesh has authorized certain branches of banks for the collection of the stamp duty and registration charges in Himachal Pradesh. You can approach such branches and pay the applicable stamp duty.

SHCIL Branches– In addition to the bank branches, the Himachal Pradesh government has also authorized some branches of the Stock Holding Corporation of India Ltd (SHCIL). You can approach the designated branches and pay the applicable stamp duty charges in Himachal Pradesh.

Stamp Duty on Various Instruments in Himachal Pradesh

In addition to the Sale Deed, the Department of Revenue in Himachal Pradesh levies stamp duty charges on various instruments other than the Sale Deed. The following stamp duty charges are applicable on various instruments-

| Stamp Duty on various Instruments in Himachal Pradesh | ||

| Sr No | Instruments | Stamp Duty Charges |

| 1 | Gift Deed | 4-6 Percent |

| 2 | Will Deed | Rs 200 |

| 3 | Lease Deed | Rs 200 |

| 4 | General Power of Attorney (GPA) | Rs 100-200 |

| 5 | Conveyance Deed | 4-6 Percent of the Deed value |

| 6 | Special Power of Attorney | Rs 100 |

| 7 | Mortgage Deed | Rs 15 |

| 8 | Adoption Deed | Rs 37.50 |

Documents Required for Property Registration in Himachal Pradesh

The property registration process requires the submission of key documents to the SRO. The below-mentioned documents are required for registration of property or Sale Deed in Himachal Pradesh (HP).

| Sr No | Name of the Document |

| 1 | Jamabandi or Bhu Naksha HP Nasal |

| 2 | Circle Rate Document |

| 3 | Agriculturist Certificate/Permission (According to Section 118 of HP TRA) |

| 4 | Self Declaration/Affidavit of the Buyer and Seller specifying distance of land from road |

| 5 | Identity Proof of both Buyers and Sellers |

| 6 | PAN Cards of both seller and buyer |

| 7 | Valuation Certificate of a Builtup area (If sale includes built-up area) |

| 8 | Copy of an approved map (If the built up area falls under municipal limits) |

| 9 | Copy of Tatima Document (If it is a Tatima Registry) |

In addition to the above-mentioned documents, the Sub-registrar can require a buyer or a seller to submit any other document on a case to case basis.

Conclusively, payment of Stamp duty charges in Himachal Pradesh is an essential step in property registration in Himachal Pradesh. The failure to deposit the stamp duty in Himachal Pradesh might lead to the non-registration of the sale transaction in the Government records. The non-payment of the stamp duty in Himachal Pradesh might also result in legal or Title disputes at a later stage.